Raising a family is a joyous journey, but it also comes with a heavy responsibility: ensuring your loved ones’ financial security. Term insurance best offers a safety net, providing financial protection in case of the unexpected. Finding the best term insurance policy can be challenging, especially for young families navigating a complex market. This guide explores top-rated companies and key features to help you find the best term insurance for your family’s needs.

Toc

- 1. The Importance of Term Insurance Best for Young Families

- 2. Key Features to Look for in the Best Term Insurance Policy

- 3. Top-Rated Term Insurance Companies for Young Families

- 4. Tips for Finding the Best Term Insurance for Your Family

- 5. Factors That Affect Term Insurance Rates

- 6. Frequently Asked Questions (FAQ)

- 7. Conclusion: Securing Your Familys Future with the Best Term Insurance

The Importance of Term Insurance Best for Young Families

For young families, the importance of term insurance best cannot be overstated. For a healthy 35-year-old, securing a 20-year term insurance policy can cost as little as $32 per month. This surprisingly affordable coverage provides a crucial safety net for young families, especially during the formative years of child-rearing.

Term insurance is designed to provide a death benefit to your beneficiaries in the event of your untimely passing, ensuring they are financially protected. This coverage can help pay off debts, cover living expenses, and fund future needs such as education for your children. For example, if a parent with a $500,000 term life insurance policy passes away, their family would receive a lump sum payment of $500,000. This money could be used to pay off a mortgage, cover living expenses for the surviving spouse and children, or fund college tuition. The peace of mind that comes with knowing your family will be taken care of in your absence is invaluable.

Understanding the Financial Implications of Not Having Coverage

Some might argue that young families with healthy finances and a strong support system don’t need term life insurance. While having a solid financial foundation is helpful, unforeseen events can still occur. Even young families with stable incomes could face significant financial hardship if a primary income earner passes away. Term life insurance provides a safety net to protect the family’s future.

Imagine a young family struggling to make ends meet after the unexpected loss of a parent. Without adequate life insurance, the burden of debt, lost income, and future expenses could overwhelm them. A study by the Insurance Information Institute found that 57% of households with children under the age of 18 own some form of life insurance, underscoring the importance of this coverage for young families.

In today’s world, with rising costs of living and increasing financial responsibilities, having a term insurance policy is not just a luxury; it’s a necessity. It ensures that your family’s lifestyle is maintained even in your absence, allowing them to grieve without the added stress of financial burdens.

Key Features to Look for in the Best Term Insurance Policy

When searching for the best term insurance policy for your family, there are several key features to consider:

Term Length

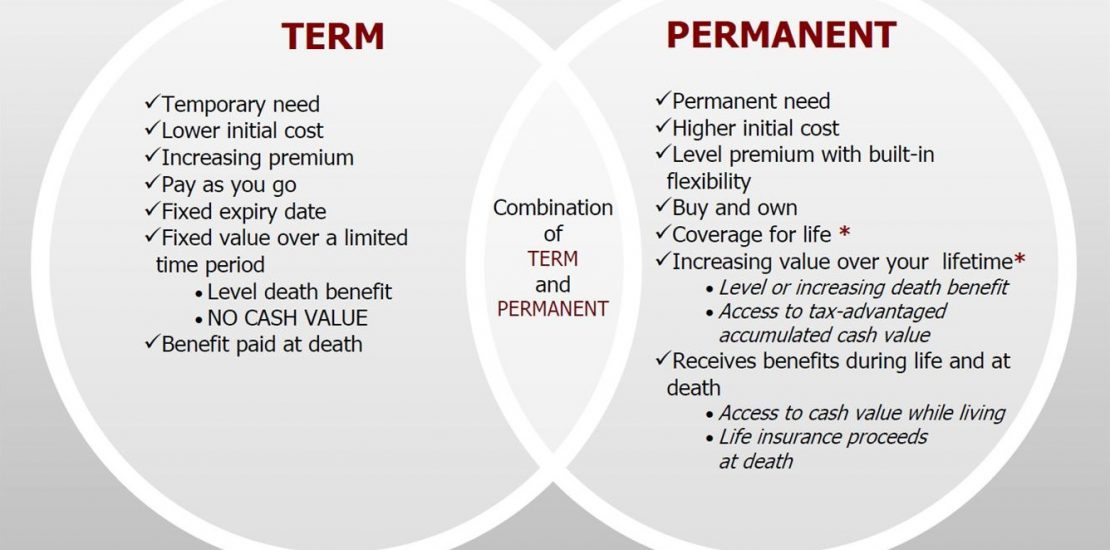

The most common term lengths range from 10 to 30 years, with 20-year terms being the most popular. For instance, a 30-year term might be suitable for a young family with newborns, ensuring coverage until the children are adults. However, if a family is nearing retirement with fewer financial obligations, a 10-year term might be more cost-effective. It’s essential to consider your family’s current and future financial needs when choosing a term length. Some insurers, like Protective and Banner, even offer term lengths up to 40 years, catering to families with longer-term needs.

Choosing the right term length is crucial. If you have young children, a longer term can provide peace of mind that they will be protected until they are financially independent. On the other hand, if your financial obligations are expected to decrease over time, a shorter term might suffice.

Coverage Amount

Determining the appropriate coverage amount is vital. This should be based on your family’s needs, such as outstanding debts, income replacement, and future expenses. For example, a family with a mortgage, student loans, and young children might need a higher coverage amount than a family with no debt and older children. A good rule of thumb is to multiply your annual income by 10 to 15 to estimate the right death benefit. This can help ensure your family’s financial obligations are covered in the event of your passing. Additionally, consider any unique needs, such as a child with special needs or a business that relies on your income.

Consider all the financial responsibilities you currently have. This includes your mortgage, student loans, credit card debt, and any other financial obligations. Additionally, think about how much money your family would need to maintain their current lifestyle and fund future goals, such as education for your children.

Riders

Optional riders can enhance your best term insurance policy, providing additional benefits that can be crucial for your family’s specific needs. Some common riders include:

- Accidental Death Benefit: Provides additional coverage in case of accidental death, ensuring your family receives extra financial support during a tragic time.

- Child Rider: Offers coverage for your children in case of their passing, which can provide a small amount of financial relief during an incredibly emotional time.

- Waiver of Premium: Waives your premiums if you become disabled and unable to work, ensuring your coverage continues even when you can’t pay.

- Return of Premium: Refunds your premiums if you outlive the term, providing a financial benefit that can be reinvested or used for other purposes.

While some might argue that riders are unnecessary and add unnecessary costs to the policy, they can provide valuable protection for specific situations. For example, an accidental death benefit rider can provide additional financial support if a death occurs due to an accident. It’s crucial to assess your family’s needs and determine if any riders would be beneficial.

No-Medical-Exam Options

Many term insurance companies offer no-medical-exam policies, which can be particularly convenient and affordable for young families. These policies typically require applicants to complete a detailed health questionnaire instead of undergoing a full medical exam, making the application process quicker and simpler. This is especially beneficial for busy families who may not have the time to schedule and attend a medical exam.

Top-Rated Term Insurance Companies for Young Families

When it comes to finding the best term insurance policy for young families, several providers stand out due to their offerings and customer satisfaction:

Protective

Key Features:

- Affordable premiums, tied with Banner for the lowest rates

- No-medical-exam options available

- Term lengths up to 40 years

- Convenient online application process

Pros:

- Extensive coverage options, including up to $50 million in coverage

- Flexibility to customize the policy

Cons:

- Below-average customer satisfaction ratings compared to industry peers

Protective is known for its affordability and flexibility, making it an excellent choice for young families seeking comprehensive coverage without breaking the bank.

Key Features:

- Affordable premiums, tied with Protective for the lowest rates

- Term lengths up to 40 years

- Online quoting and application process

- Ability to “stack” term riders for potential savings

Pros:

- Very few customer complaints relative to its size

- Flexible coverage options

Cons:

- No credit card payment option, though digital wallet payments are accepted

Banner by Legal & General offers competitive pricing and a user-friendly online experience, making it easy for families to secure the coverage they need.

Mutual of Omaha

Key Features:

- Includes a wide range of living benefits at no additional cost, such as terminal, chronic, and critical illness coverage

- Offers a disability income rider and return-of-premium term policies

- Requires working with an agent to apply

Pros:

- Comprehensive coverage options for families

- Potential to recoup premiums if you outlive the term

Cons:

- Cannot apply without an agent

Mutual of Omaha is a solid choice for families looking for extensive living benefits and the option to recoup premiums, offering both peace of mind and financial flexibility.

MassMutual

Key Features:

- Highest financial strength rating from AM Best (A++)

- Broad choice of term conversion options to permanent policies

- Excellent customer service reputation

Pros:

- Exceptional financial stability and very few complaints

- Flexible conversion options if your needs change

Cons:

- Does not accept credit card payments

MassMutual stands out for its financial strength and customer service, making it a reliable option for families seeking long-term security.

Tips for Finding the Best Term Insurance for Your Family

When shopping for the best term insurance policy for your family, consider these essential tips:

- Compare Quotes: Get quotes from multiple insurers to find the best rates and coverage options. Don’t just settle for the first quote you receive, as prices can vary significantly between providers. Using online comparison tools can simplify this process.

- Evaluate Your Needs: Carefully assess your financial obligations, income replacement requirements, and future goals to determine the appropriate coverage amount and term length. This will help you find a policy that truly meets your family’s needs.

- Explore Riders: Review the available riders and consider adding any that align with your family’s specific needs. Riders like accidental death benefit or child coverage can provide valuable supplementary protection.

- Read the Fine Print: Carefully review the policy documents to understand the terms, exclusions, and any limitations before signing. This can help you avoid any surprises down the road and ensure you know exactly what you’re getting.

- Seek Professional Advice: Consider consulting with a financial advisor who can provide personalized guidance on the best term insurance policy solution for your family. They can help you navigate the options and ensure you make an informed decision.

Factors That Affect Term Insurance Rates

When it comes to the cost of term insurance, several factors can influence the premiums you’ll pay, including:

- Age: Younger applicants typically pay lower premiums, as they are statistically less likely to pass away during the policy term.

- Gender: Women generally pay lower rates than men, as they have a longer life expectancy on average.

- Health Status: Applicants in good health will qualify for lower rates, while those with pre-existing medical conditions may face higher premiums.

- Lifestyle: Risky hobbies or occupations can lead to higher term insurance costs. For example, if you participate in extreme sports or have a high-risk job, be prepared for higher premiums.

- Coverage Amount: The higher the death benefit you choose, the higher your premiums will be. It’s essential to balance the amount of coverage you need with what you can afford.

- Term Length: Longer term lengths typically result in higher premiums, as the insurer is taking on more risk over a more extended period.

Understanding these factors can help you make informed decisions and find the best term insurance policy for your family’s needs.

Frequently Asked Questions (FAQ)

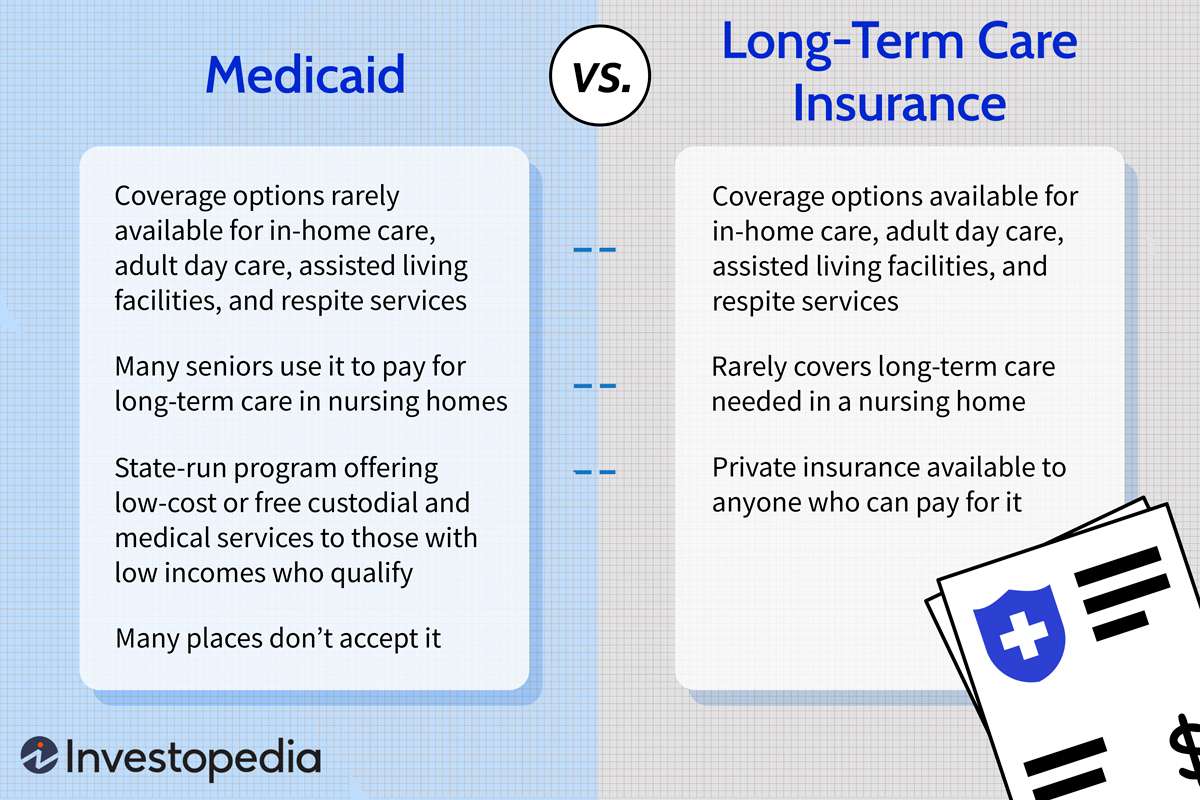

Q: What is the difference between term insurance and whole life insurance?

A: Term insurance provides temporary coverage for a specific period, while whole life insurance offers lifelong protection and a cash value component. Term insurance is generally more affordable but doesn’t offer cash value, while whole life is more expensive but provides permanent coverage.

Q: What is the best term length for a young family?

A: A 20-30 year term is often recommended to cover a child’s upbringing and education. This timeframe can provide financial security during the critical years of your family’s growth.

Q: How can I determine the right coverage amount for my family?

A: Calculate your family’s total debts, including mortgage, student loans, and credit card balances. Estimate how many years of income your family would need to replace. Consulting with a financial advisor can provide personalized guidance.

Q: What if I outlive my term insurance policy?

A: You may have options to renew or convert your policy. If not, you can apply for a new policy, although premiums may be higher based on your age and health at that time.

Conclusion: Securing Your Familys Future with the Best Term Insurance

Finding the best term insurance policy is essential for young families to protect their financial future. By considering key features, comparing quotes, and seeking professional advice, you can find a policy that meets your needs and provides peace of mind. Start your search today and secure your family’s future. Investing in term insurance is not just about financial protection; it’s about ensuring that your loved ones can continue to thrive even in the face of life’s uncertainties. With the right coverage, you can focus on what truly matters—creating lasting memories with your family.